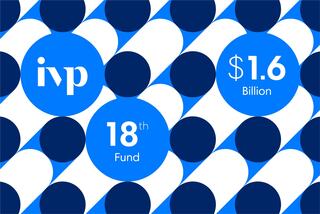

We’re launching IVP’s 18th fund at an intense— and promising — time for the industry. Instead of a typical announcement about raising $1.6B to support breakout technology companies, we decided to answer some of the questions on founders’ minds.

We are experiencing a sweeping technological shift with AI at a time when capital markets are resetting. From our experience, these periods create massive opportunities for companies with product market fit, organic momentum and the right team. Here’s our take on today’s environment, navigating the next 24 months and the relationships we aim to build at IVP:

How are the best high-growth companies extending their lead?

The market reset created a class of tenacious, responsible entrepreneurs ready to dial in on operating metrics and do big things in a smart, persistent way.

Entrepreneurs today are by far the most battle-tested I’ve seen in the 19 years since I joined IVP. They have seen so much in the last four to five years — both the highs and lows. And it’s often the most battle-tested entrepreneurs who build the biggest companies. — Somesh Dash

This isn't a raucous, Roaring Twenties kind of time. This is a time to build prudently, create value and understand that building a business is a gradual and persistent process. Our best entrepreneurs are both very persistent and very resilient. — Steve Harrick

Instead of saying, “We’re going to triple headcount,” the best founders are saying, “We're going to do more with less, and maybe we'll hire five people if we really need them.” I think that's great. I'm a frugal Minnesotan and love to help people figure out the right constraints and how to work within them. — Cack Wilhelm

Free money didn't just impact valuations and financings. It impacted the downstream customers. People are budget-conscious, and they're reducing their investments in both their own soft and hard costs. So everything's just a little harder, a little more muted. And that's fine. We're transitioning from an era that was unrealistic and unsustainable to one that is more realistic and sustainable. — Eric Liaw

Ironically, the worst times in some ways were in 2021, when things went haywire. It felt good, but it was so damaging. Now is a great time to build a business. There are fewer competitors, fewer dollars sloshing around, and things are more normal. It's a great time to raise money and beat your competition. — Tom Loverro

What should we expect over the next 12-24 months?

As companies that raised too much money at too high a price retrench, founders in a stronger position will have a chance to pull in top-notch talent — if they can tell a compelling story.

A lot of the people in Silicon Valley who enjoy innovation and disruption want to get back in the game. They want to build again — to have a team, to innovate, and to compete. That’s exciting because the quality of talent that's looking to go to startups right now is very, very high. — Somesh Dash

Overfunded startups with sky-high valuations will start to struggle — and that will have ripple effects throughout our industry. Talent will become more available, and breakout companies with strong business models will accelerate by bringing on the best execs and engineers, fast. — Alex Lim

When you're a high-growth CEO, you need to recruit great people and great talent. So high-growth CEOs have to be good storytellers. You can't outbid Google or Meta for an AI engineer, but you can get them to resonate with your vision and come join you to build something special. — Steve Harrick

While the public market re-opening may be more sluggish than we’d like, the best entrepreneurs are already putting a plan in place.

If you look back at different decades, 90% of exits are usually concentrated in a few years. We might have some IPOs this year and it only takes a few high-quality companies to help reenergize the exit markets. Great CEOs should be ready for the next window. — Cack Wilhelm

I hope by the second half of 2025, all the incredible high-quality growth-stage companies at scale that are ready to go public will begin to access the market. But there's a ton of work that goes into that. Now is the time to start preparing for an IPO, and it helps to work with experts who can help you hire strategic finance leaders, identify new growth levers for your business, and navigate the best path to a public exit. — Ajay Vashee

What should founders look for in a partner?

The best partnerships aren’t defined by dollars on a term sheet. They’re about the substance and soul of investors and the relationship they build with founders they believe in. We think a lot about founder-investor fit. Founders should, too.

You don’t survive in this business for as long as we have if you’re not putting in the work to build relationships and support companies through good times and tough times. When you take on an investor, you're going to be seeing and working with that person for three, five, seven, sometimes 10 years. Think about how you're going to build a company and who can help you do that. — Eric Liaw

The best founders have their pick of investors, who bring their own skills, relationships, and counsel, along with their capital. Ultimately, what really matters is whether you have someone who really, deeply believes in you. Because then they’ll bend over backward for you. — Cack Wilhelm

As board members, our top priority is to help founders succeed. That means not just telling them what they want to hear, but what they need to hear.

It’s easy to say you’re a good board member. It’s very hard to prove it. Where we excel is really being a partner to the CEO. We’re not always going to say yes to everything the CEO wants - that’s the easy way to be a good board member. Instead, we’re appropriately independent, not afraid to give tough love, but also kind and gracious. — Tom Loverro

As an active partner, you can be super loud and create more of a headwind than a tailwind for a company. Or you can be a partner who asks the right questions and challenges the company to operate at a higher level in a principled, thoughtful way. We are very much the latter, and I think very few firms can step into that mold. — Ajay Vashee

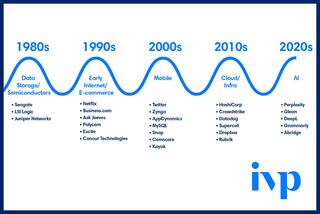

It’s bittersweet to announce our new fund along with the passing of a venture capital legend. We honor the vision of Reid W. Dennis, who founded IVP in 1980 and supported CEOs, IVP colleagues and the larger Silicon Valley community in countless ways over the decades. His pioneering spirit lives on at IVP, as we partner with each new generation of companies.

Even the most undaunted need someone with deep experience who can help them navigate uncertain times and grow into enduring market leaders. With IVP 18, we’re ready to help a new generation of companies define their categories. We can’t wait to build with you on the road ahead.

– Team IVP